The Definitive Guide for Property By Helander Llc

Table of Contents5 Easy Facts About Property By Helander Llc DescribedExcitement About Property By Helander LlcWhat Does Property By Helander Llc Do?Indicators on Property By Helander Llc You Should KnowThe smart Trick of Property By Helander Llc That Nobody is Talking AboutEverything about Property By Helander Llc

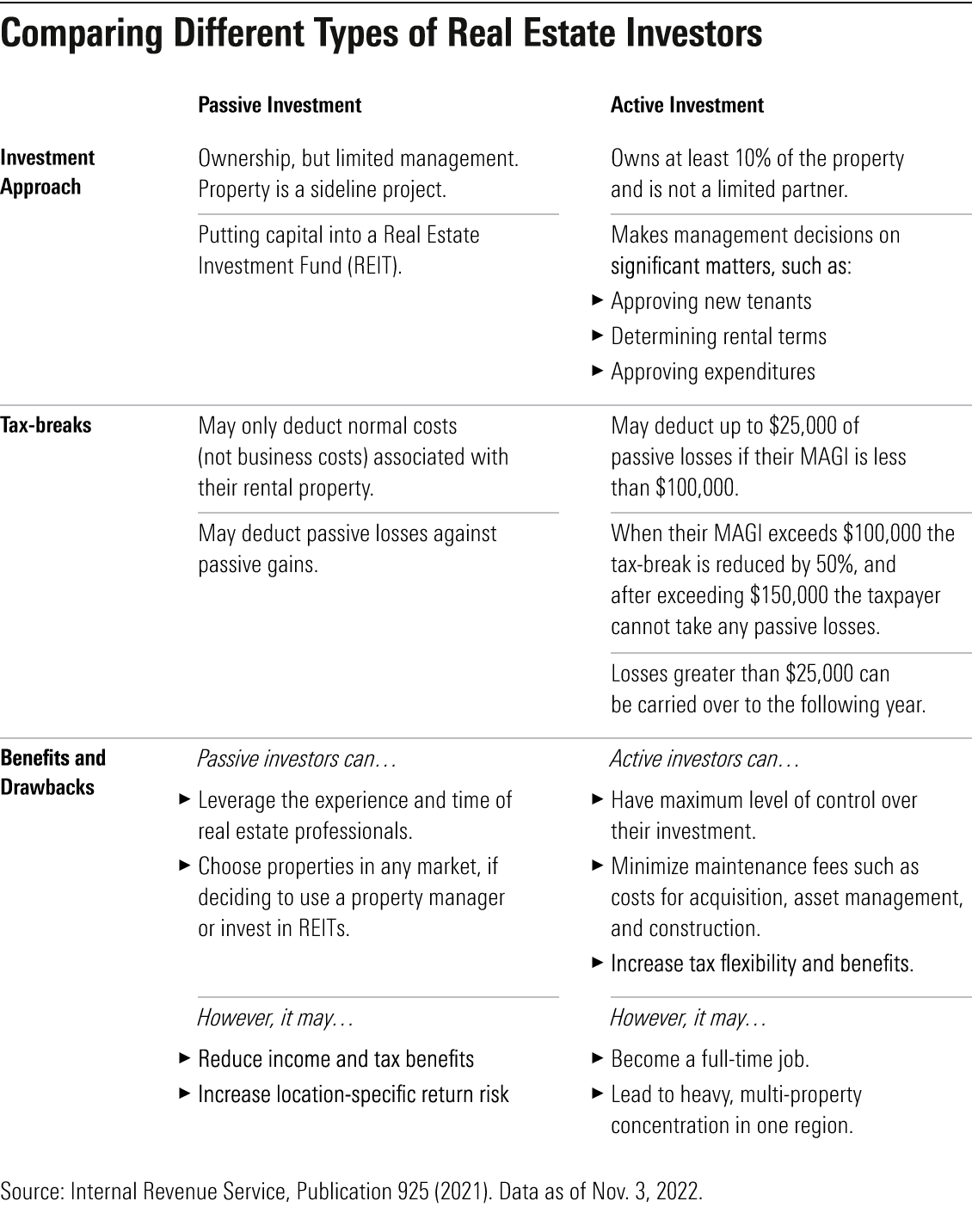

The advantages of investing in actual estate are various. Here's what you need to know regarding real estate benefits and why real estate is considered an excellent investment.The benefits of investing in real estate consist of easy earnings, stable money flow, tax advantages, diversification, and utilize. Real estate investment trusts (REITs) provide a means to spend in real estate without having to own, run, or financing residential properties.

Oftentimes, cash flow only strengthens in time as you pay for your mortgageand accumulate your equity. Investor can make use of numerous tax breaks and reductions that can conserve money at tax time. Generally, you can subtract the affordable prices of owning, operating, and handling a property.

How Property By Helander Llc can Save You Time, Stress, and Money.

Realty values have a tendency to boost with time, and with an excellent financial investment, you can transform a profit when it's time to offer. Rental fees likewise have a tendency to rise over time, which can cause higher money flow. This chart from the Federal Get Bank of St. Louis reveals typical home prices in the U.S

The locations shaded in grey suggest united state economic crises. Mean Sales Rate of Houses Cost the USA. As you pay for a building home mortgage, you build equityan property that becomes part of your total assets. And as you construct equity, you have the leverage to purchase even more residential or commercial properties and raise cash money flow and wealth much more.

Due to the fact that realty is a substantial asset and one that can serve as security, financing is conveniently available. Realty returns vary, depending upon factors such as area, possession class, and administration. Still, a number that many investors go for is to defeat the typical returns of the S&P 500what many individuals refer to when they say, "the market." The rising cost of living hedging capability of property comes from the favorable connection in between GDP growth and the demand genuine estate.

A Biased View of Property By Helander Llc

This, subsequently, converts right into greater funding values. Consequently, realty often tends to maintain the acquiring power of funding by passing a few of the inflationary pressure on lessees and by integrating a few of the inflationary stress in the type of resources recognition. Home mortgage borrowing discrimination is unlawful. If you think you've been discriminated versus based on race, religion, sex, marriage condition, usage of public aid, national beginning, handicap, or age, there are actions you can take.

Indirect property investing includes no direct ownership of a residential or commercial property or properties. Rather, you spend in a pool in addition to others, whereby a monitoring business possesses and operates residential or commercial properties, otherwise owns a profile of home mortgages. There are a number of manner ins which possessing actual estate can secure against rising cost of living. Property worths might climb higher than the rate of rising cost of living, leading to resources gains.

Finally, buildings funded with a fixed-rate financing will certainly see the loved one amount of the month-to-month home mortgage settlements tip over time-- for circumstances $1,000 a month as a fixed repayment will end up being much less challenging as inflation deteriorates the purchasing power of that $1,000. Typically, a main home is ruled out to be a realty financial investment considering that it is made use of as one's home

Little Known Questions About Property By Helander Llc.

Investing in realty can be an extremely gratifying and profitable undertaking, yet if you resemble a great deal of new capitalists, you may be wondering WHY you must be purchasing property and what advantages it brings over other financial investment opportunities. In addition to all the remarkable benefits that come along with buying property, there are some downsides you need to take into consideration too.

The 6-Minute Rule for Property By Helander Llc

If you're trying to find a way to purchase right i was reading this into the realty market without having to invest thousands of countless bucks, take a look at our homes. At BuyProperly, we use a fractional possession model that allows capitalists to start with just $2500. One more significant benefit of realty investing is the capability to make a high return from acquiring, remodeling, and re-selling (a.k.a.

Rumored Buzz on Property By Helander Llc

As an example, if you are charging $2,000 rent each month and you sustained $1,500 in tax-deductible expenses monthly, you will only be paying tax obligation on that $500 earnings each month. That's a big difference from paying taxes on $2,000 per month. The earnings that you make on your rental for the year is considered rental income and will certainly be tired accordingly

Comments on “The Best Guide To Property By Helander Llc”